So $50 in spending will net you $5 cash back. You can also earn 10% cash back when shopping with select merchants, such as Kohl’s,, and many others, online via Chase’s Ultimate Rewards portal. If you’re bothered by limits, check out the newer Chase Freedom Unlimited, which as the name implies offers unlimited 1.5% cash back all year long. They show the purchase total, then 4x the total and 1x the total, for 5x total points. It’s not hard to do, but you still need to remember to visit the website and enter some pertinent details every quarter.Īs you can see, they break it down for you in your account activity rather nicely (and immediately) so you can see that you’re earning the 5x bonus points. But if they presented it that way we wouldn’t all be so excited, would we?Īdditionally, you have to “activate the cash back” each quarter in order to get it. That’s taking the 4% bonus amount on top of the 1% you already get for purchases 365 days a year.

So really the max bonus cash you can earn is $60 per quarter (6,000 points).

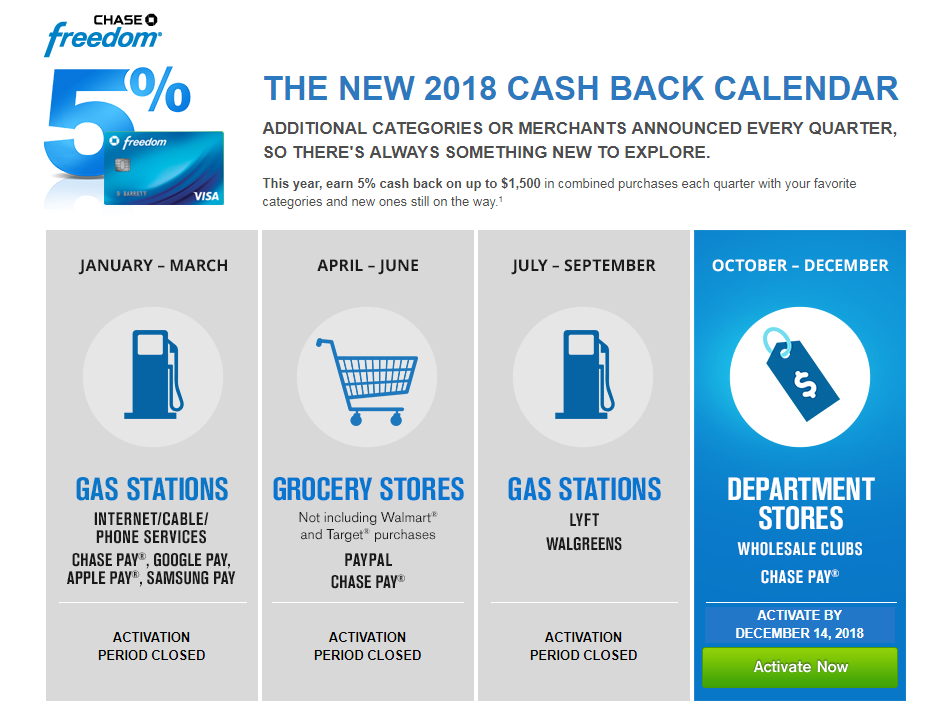

It’s maxed out at $1,500 per category, per quarter. The only drawback here is that the 5% cash back is not unlimited. So cardholders may want to use the Chase Freedom credit card at certain places during specific times of the year to maximize their cash back. Every three months, new categories are unveiled that allow you to earn a total of 5% cash back.Ĭategories include things like gas, groceries, restaurants, and more. On top of the everyday 1% cash back is 4% more cash back in rotating categories. The only thing you don’t earn cash back on is balance transfers, cash advances, money orders, and traveler’s checks. You also get an additional point for every dollar spent on airfare purchased through the company’s online booking tool. Oh, and the points never expire.Įach point is worth a penny if redeemed for cash back, which is the industry standard. You earn 1% cash back on all purchases (1 point per $1 spent) with no minimum annual spend and no maximum to how many points you can earn. And my favorite combination for a credit card, assuming the rewards are lucrative enough. Today, we’ll take a closer look at the “Chase Freedom Card,” which is probably the card issuer’s most popular credit card at the moment.įirst and foremost, Chase Freedom is a cash back credit card with no annual fee, which is its biggest draw. You can earn $150 after spending $500 in the first three months. I actually have this card in my wallet and have had it for several years so this is my real personal experience.

0 kommentar(er)

0 kommentar(er)